Mastering Crypto Charts: Types, Elements, and Trading Strategies

Cryptocurrency trading has become increasingly popular recently, with digital assets like Bitcoin and Ethereum gaining widespread attention. You must understand how to read crypto charts to navigate the crypto market successfully. In this guide, we’ll take you through the essential elements of crypto charts, common chart types, and strategies for interpreting them to make informed trading decisions.

Table of Contents

- What Are Crypto Charts?

- Types of Crypto Charts

- Key Elements of Crypto Charts

- Reading Candlestick Charts

- Understanding Chart Patterns

- Technical Analysis Indicators

- Developing a Trading Strategy

- Frequently Asked Questions (FAQs)

- What timeframes should I consider when analyzing crypto charts?

- How can I stay updated with the latest crypto chart analysis and news?

- How can I use support and resistance levels on a crypto chart?

- What is a moving average, and how does it help in crypto chart analysis?

- Can I use crypto charts for long-term investment decisions?

- What are some common mistakes to avoid when reading crypto charts?

- Conclusion

What Are Crypto Charts?

Crypto charts, also known as cryptocurrency price charts or trading charts, are visual representations of a cryptocurrency’s price movements over time. They display historical price data, allowing traders and investors to analyze past trends and predict future price movements.

To understand how to read crypto charts effectively, it’s crucial to familiarize yourself with key chart elements and concepts.

Types of Crypto Charts

- Line Charts: Line charts are the simplest type of crypto chart. They display a cryptocurrency’s closing prices over a specified period as a continuous line. They are useful for getting a general overview of price trends but lack detailed information.

- Bar Charts: Bar charts represent the price movement of a cryptocurrency over a specific time frame using vertical bars. Each bar includes the opening, closing, high, and low prices for that period. Traders can quickly see the price range and identify trends and reversals.

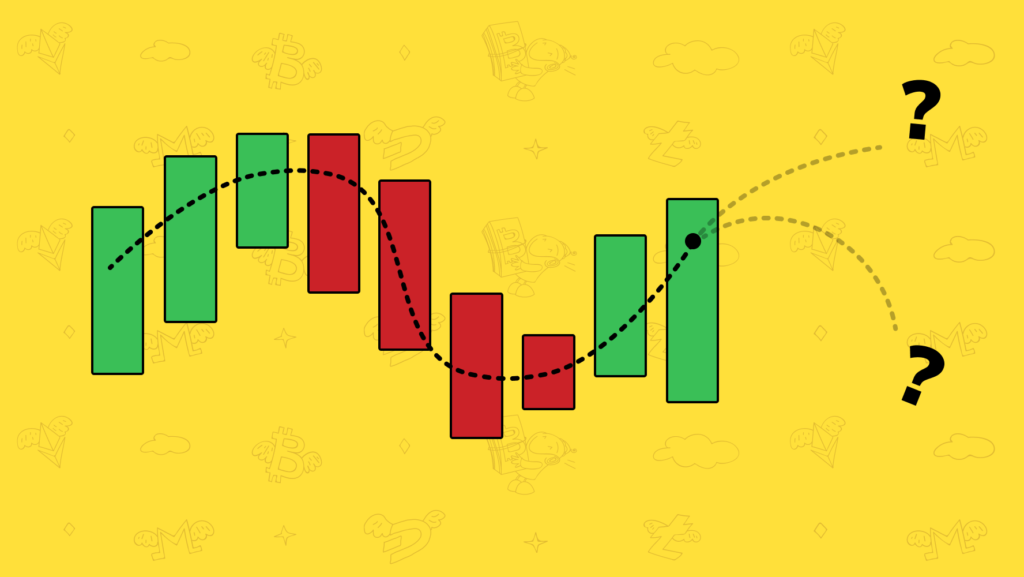

- Candlestick Charts: Candlestick charts provide a comprehensive view of price movements. Each candlestick represents a specific time period, including the opening and closing prices and the high and low prices during that period. Candlestick patterns can reveal important information about market sentiment and potential price reversals.

Key Elements of Crypto Charts

- Price: The cryptocurrency’s price is the primary data displayed on crypto charts. This information is essential for making trading decisions, indicating whether the asset is trending up, down, or moving sideways.

- Time: Crypto charts can be customized to display different time frames, such as minutes, hours, days, or weeks. Traders use these time frames to analyze short-term or long-term price trends.

- Volume: Volume data shows the number of cryptocurrency units traded during a specific time period. High volume can indicate strong market participation and potential price movements, while low volume may suggest a lack of interest or stability.

- Market Sentiment: Market sentiment is a critical element not directly displayed on charts. Traders often rely on news, social media, and sentiment analysis tools to gauge the market’s feelings about a particular cryptocurrency, as sentiment can influence price movements.

Reading Candlestick Charts

Candlestick charts provide various patterns, such as doji, hammer, shooting star, and engulfing patterns. Traders study these patterns to identify potential entry and exit points. For example, a bullish engulfing pattern may suggest a reversal from a bearish trend.

Understanding Chart Patterns

Chart patterns are visual representations of historical price movements. Recognizing patterns like head and shoulders, triangles, and flags can help traders anticipate future price movements. For instance, a breakout from a triangle pattern might indicate a significant price movement.

Technical Analysis Indicators

Technical indicators are mathematical calculations applied to price and volume data. They provide insights into trends, momentum, and potential reversals. For instance, the Relative Strength Index (RSI) measures overbought or oversold conditions, helping traders decide when to buy or sell.

Developing a Trading Strategy

A trading strategy outlines a trader’s approach to the market, including entry and exit rules, risk management, and position sizing. Different strategies, such as day trading (short-term), swing trading (medium-term), and long-term investing, cater to various risk profiles and time horizons. Chart analysis plays a crucial role in identifying opportunities within these strategies.

To become a successful crypto trader, it’s essential to understand these aspects and practice and refine your skills over time. Additionally, staying updated with the latest news and developments in the cryptocurrency market is crucial for making informed decisions based on chart analysis.

Frequently Asked Questions (FAQs)

What timeframes should I consider when analyzing crypto charts?

The choice of timeframe depends on your trading style. Short-term traders often use charts with hourly or 15-minute intervals, while long-term investors may prefer daily or weekly charts. It’s essential to match the timeframe to your trading goals and strategy.

How can I stay updated with the latest crypto chart analysis and news?

You can stay informed by following reputable cryptocurrency news websites, subscribing to crypto-focused social media channels, and joining online communities. Additionally, many trading platforms provide real-time charting and analysis tools.

How can I use support and resistance levels on a crypto chart?

Support levels are price levels where an asset tends to find buying interest, preventing it from falling further. Resistance levels are where selling interest typically emerges. Traders use these levels to set entry and exit points and identify potential price reversals.

What is a moving average, and how does it help in crypto chart analysis?

A moving average is a trend-following indicator that smoothes out price data over a specific period. It helps traders identify the overall trend direction and potential trend reversals. The two most common types are the simple moving average (SMA) and the exponential moving average (EMA).

Can I use crypto charts for long-term investment decisions?

Yes, crypto charts are valuable for long-term investors. They help you identify entry points during market corrections or downtrends and determine when to accumulate assets for the long haul.

What are some common mistakes to avoid when reading crypto charts?

Common mistakes include overtrading (excessive buying and selling), ignoring risk management, and relying solely on chart analysis without considering fundamental factors. It’s crucial to have a well-rounded approach to trading and investing.

Conclusion

Reading crypto charts is a fundamental skill for anyone interested in cryptocurrency trading. By understanding the various chart types, essential elements, and technical analysis tools, you can make more informed decisions and increase your chances of success in the volatile crypto market. Start practicing your chart-reading skills and continually refine your strategies to stay ahead in this exciting space.